Across the Nation, Americans say “NO”

to the Beverage Tax

We’ve seen the power of our collective voice all across the country— from Santa Fe, N.M. to Cook County, Ill.— where people have already come together to defeat excessive taxes on their everyday grocery items.

Washington Said YES to Affordable Groceries

Voters in Washington voted to prohibit new local grocery taxes in the 2018 election.

The Arizona Victory

Arizona took a stand and proactively stopped the government from singling out everyday grocery items for taxation.

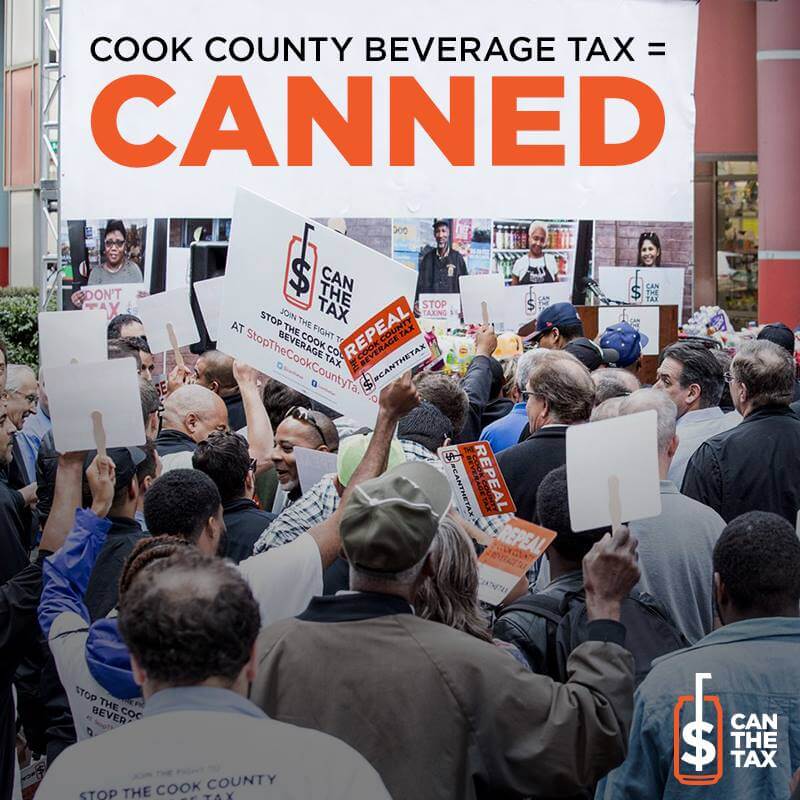

Cook County Crushes Beverage Tax

A beverage tax lasted just two months in Cook County before commissioners voted to repeal it, due to a massive public outcry.

Santa Fe Votes AGAINST a Beverage Tax

Santa Fe voters saw through the beverage tax pushed by their elected officials and outside elites – soundly defeating it by a wide margin.

The Seattle Beverage Tax

In Seattle, the cost of beverage taxes is dangerously high. This excessive tax is harming businesses, costing working families and making the city less livable overall.

The Philadelphia Beverage Tax

Philadelphia has shown us just how much damage a beverage tax can do — hard-working families and businesses are paying the price.

Michigan’s Tax-Free Groceries

Michigan fought to keep food and beverages affordable – and won a legislative victory to prevent unfair taxes that would damage their communities.

The Mexico Story

Backers of the beverage tax in Mexico made big promises, but didn’t deliver on any of them. The tax didn’t combat obesity, but caused 30K store closures and 50K job cuts.

The Berkeley Beverage Tax

The Berkeley beverage tax has backfired. Since the tax took effect, people are consuming more calories than before – from non-taxed beverages.