How Taxing Sugary Drinks Can Make People Fatter

Sugary drink taxes drive some consumers to purchase substitute products that pose equal or greater health risks, and others to buy sweetened beverages outside city limits.

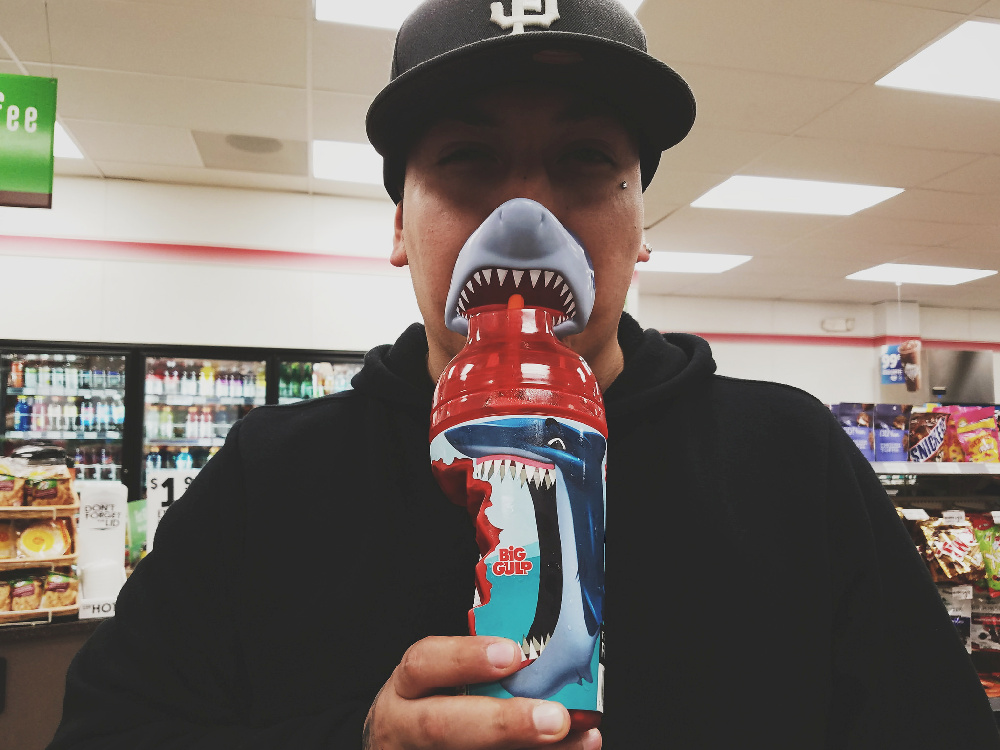

The tax man cometh for purveyors of sugary drinks—and for consumers forced to absorb a slew of new, not-so-sweet excise taxes. In a government-spearheaded effort to promote healthier lifestyles and fill public coffers, more U.S. cities are assessing taxes on sugar-sweetened beverages (SSBs). State lawmakers are considering imposing similar taxes.

Cities typically tax retailers 1 to 2 cents per ounce of SSB sold. In most cases, retailers pass this cost on to shoppers. The idea is to tax citizens unto greater health by dissuading them, one cent at a time, from buying soda and other sweetened drinks.

Data on the effectiveness of such taxes is just now surfacing, and much of it lends itself to being spun however ideologues want. But market principles reign. Sugary drink taxes drive some consumers to purchase substitute products that pose equal or greater health risks. The same taxes drive other consumers to buy equal or greater quantities of sweetened beverages outside city limits.