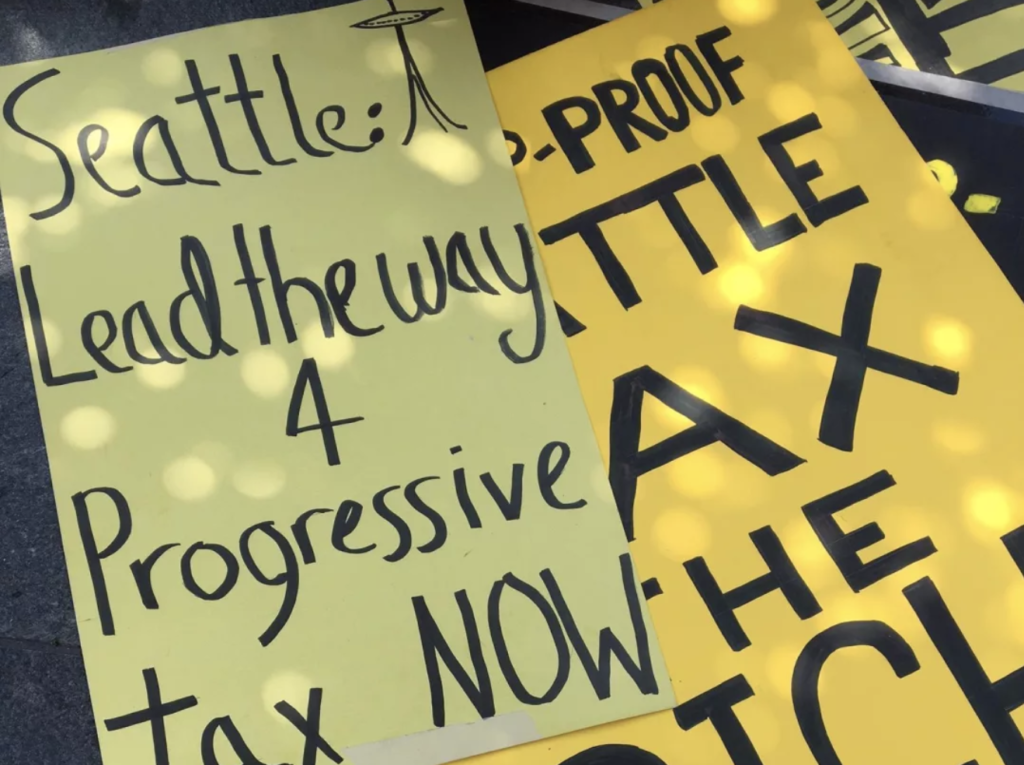

Report: Washington State Taxes Are Still the Most Inequitable in the Country

In Washington state, the less money you make, the larger your percentage of income goes toward taxes.

A study from the Institute on Taxation and Economic Policy released on Wednesday concludes that Washington state still has the most regressive taxes in the U.S., meaning the poorest households pay a disproportionate amount of taxes compared to the richest households in the state.

The study takes into account new laws as of September and uses 2015 income data. Families who make less than $24,000 a year—the poorest 20 percent of the state—pay an estimated 17.8 percent of their income. Those making more than $545,900—the richest 1 percent—pay just 3 percent.